Public Debt Management Office

The Directorate is headed by a Director General, reporting to the Cabinet Secretary. The main objectives of the Directorate is to:-

- Minimise the cost of public debt management and borrowing over the long-term taking account of risk

- Promote the development of the market institutions for Government debt securities; and,

- Ensure the sharing of the benefits and costs of public debt between the current and future generations.

The Directorate is organized into three (3) Technical Departments, each headed by a Director. They include:

Every financial year, the Government borrows to finance fiscal deficit as stipulated in the Budget Policy Statement and also to pay off maturing debts. The Medium-Term Debt Management Strategy gives the borrowing composition optimising costs and risks of public debt management. The Government borrows from external and domestic sources. From the external sources, money is raised loans, (bilateral, multilateral or syndication) and issuance of international sovereign bonds while from domestic sources, money is raised through Treasury bills and bonds.

Domestic issuance of securities is through the Central Bank of Kenya as fiscal agent of the Government.

These are secure, short-term investment instruments which are are issued every week on Thursdays and settled on Monday. In terms of tenors, they are categorised into 91-days, 182 days and 364-days. They are sold at a discount meaning that the investors can choose the amount that they will receive when the bill matures, and pay less than the amount when purchasing it. Individuals and corporate bodies can invest in Treasury bills as a nominee of a commercial bank or investment bank, or if one hold a bank account with a local commercial bank, they can also invest directly through the Central Bank.

They are secure, medium to long-term investment that typically offer interest payments every six months throughout the bond’s maturity. The are issued on a monthly basis with tenors of 2, 5, 10, 15, 20 and 25 years. In addition, the Government occasionally issues tax-exempt infrastructure bonds which are very attractive in terms of investment. Individuals and corporate bodies can invest in Treasury bonds as a nominee of a commercial bank or investment bank, or if one holds a bank account with a local commercial bank, they can also invest directly through the Central Bank.

To lend to Government, an investor submits a bid of an amount to be invested and defines interest. Every submitted bids must comply with the following rules and guidelines:

- Investors in the diaspora may submit their bids via email: primaryissues@centralbank.go.ke

- Application forms for bids may be downloaded from the CBK website and are also available at the Financial Markets counter in the CBK banking hall, CBK branches and Centres.

- In the case of manual submissions, bids must be submitted using application forms available at the Central Bank of Kenya (Fiscal Agent): https://www.centralbank.go.ke/; and +254 20 286 0000. Fully completed and signed forms must be dropped in the Tender boxes, clearly marked “Treasury Bills/Treasury Bonds” in the banking hall during the sale period specified in the advertisement.

These are debt instruments sold to investors largely in key source markets outside Kenya. They are exchange-listed or traded (e.g. in Luxembourg, London or Dublin), and therefore, disclosure requirements must conform to exchange practices and the financial markets authorities in those jurisdictions. Lastly the interest payments on Eurobonds, are paid semi-annually and are free of any withholding, income or other taxes.

National Treasury may borrow money from credible sources including from: multilateral, bilateral and commercial institutions sources. Under the bilateral and multilateral creditors, the terms are concessional i.e. long grace periods and maturities, and low interest rate; they are focused on economic development and social welfare. The commercial creditors offer terms that are market based and the loans can be project specific or for budget support.

The Government can also raise money through selling of bonds to pre-selected investors, banks and other financial institutions, mutual funds, insurance companies, and pension funds through private placement.

Refers to borrowings in a government to government arrangement. The arrangement follow country cooperation framework or Memorandum of Understanding as signed by the countries involved.

Under the multilateral sources, the terms are concessional i.e. long grace periods and maturities, and low interest rate; they are focused on economic development and social welfare. Such institutions include the IMS, World Bank, African Development Bank among others.

Refers to borrowings that are facilitated by a specific country export credit agency and guaranteed or insured to help mitigate against uncertainty of exporting to other countries. Some of the terms include: Disbursements are linked to shipments of contracted merchandise; Interest rates are market-related – linked to OECD Consensus Guidelines and; Maturities are different but not more than 10 year.

Under the Public Private Partnership Act, 2021, Government entities can contract private sector entities to provide public utilities through long-term contractual agreements. PPP model provides public services through private sector which bears a significant amount of risk and management responsibility in return for revenue from charged services or availability payments from Government. The PPP arrangement builds on the expertise that the private sector brings in effectively managing PPP projects while the public entity ensures that the overarching social obligations are met.

Individuals and institutions wishing to lend to Government are required to have a bank account with a Kenyan commercial bank and to open an investment account at the Central Bank of Kenya (Fiscal Agent). To open an investment account, an investor is required to collect and fill a mandate card from the Central Bank or any of its branches.

National Government issues retail securities (bonds) for financial empowerment of its citizens. Retail bonds are issued through mobile phone platform (code named M-Akiba (Mobile/Digital bond). These are issued by the Public Debt Management Office through mobile/Telecommunication Network Operations. Currently M-Akiba issuance is undergoing re-engineering and through the e-citizen platform and will be relaunched when the re-engineering process is completed.

a) Treasury bonds yield curve

Click here to download the Treasury bonds Yield Curve

b) Eurobonds

Kenya Eurobonds issuance date, maturity date and coupon

| Name | Issue Date | Maturity Date | Coupon | Amount (USD Mn) |

| Kenya 24 | 24-06-2014 | 24-06-2024 | 6.875 | 2,000 |

| Kenya 27 | 22-05-2019 | 22-05-2027 | 7.000 | 900 |

| Kenya 28 | 28-02-2018 | 28-02-2028 | 7.250 | 1,000 |

| Kenya 32 | 22-05-2019 | 22-05-2032 | 8.000 | 1,200 |

| Kenya 34 | 23-06-2021 | 23-01-2034 | 6.300 | 1,000 |

| Kenya 48 | 28-02-2018 | 28-02-2048 | 8.250 | 1,000 |

| Total | 7,100 |

These bonds may be purchased through the respective exchanges where they are listed (e.g. London Stock Exchange). Citi (UK) is the fiscal agent of the Government of Kenya.

c) Outstanding Treasury Bonds

Outstanding Treasury bonds as at 30th June 2023

a) Outcome of FY 2022/23 Annual Borrowing Plan (ABP)

In FY 2022/23, the National Treasury planned to borrow Ksh. 862.92 billion to finance the budget deficit, of which net external borrowing was Ksh. 280.73 billion and net domestic borrowing totalled Ksh. 582.19 billion. At end June 2023, the National Treasury had raised Ksh. 740.33 billion, comprising of net external borrowing of Ksh. 301.06 billion (107.2% of the target); and net domestic borrowing of Ksh. 439.27 billion (75.5% of the target). The shortfalls in borrowing in FY 2022/23 was attributed to tight liquidity conditions in the domestic and international capital markets. Due to shortfalls in realizing the borrowing targets in the FY 2022/23, the National Treasury lowered the net domestic borrowing to the level that can be achieved, while ensuring the yield curve remain upward sloping; and increased mobilization of concessional external financing from alternative sources including development financial institutions.

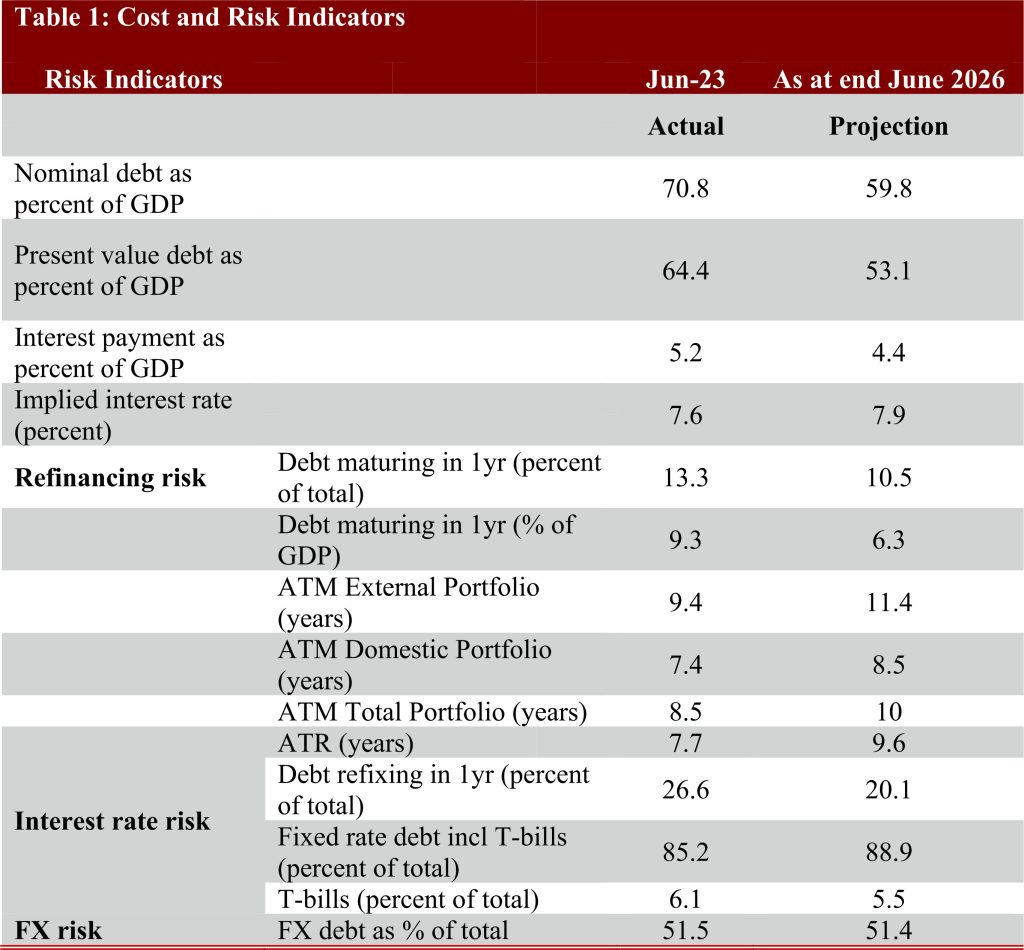

b) Costs and Risks of Kenya’s Public Debt as of End June 2026

i) The National Treasury aims to minimize costs and risks of public debt through optimizing the financing mix between domestic and external sources and instrument targeting.

ii) Under external borrowing, the National Treasury seeks to maximize on the use of concessional borrowing.

iii) From the domestic sources, the objective is to lengthen the maturity profile of public debt and support deepening of domestic market through issuance of medium to long term debt securities.

iv) Reducing costs of debt in form of interest payment as a percent of GDP from 5.2 percent in June 2023 to 4.4 by 2026 through use of fixed interest instruments and maximization of concessional sources and minimization of commercial borrowing.

v) Minimizing refinancing risk by lengthening the Average Time to Maturity (ATM) of the total portfolio, active liability management and issuance of more longer tenor domestic debt instruments. This will be complemented by use of concessional loans with longer maturities.

vi) Minimizing interest rate risk from Average Time to Refixing (ATR) of 7.7 years in June 2023 to 9.6 years in June 2026.

c) The Annual Borrowing Plan for the FY 2023/24

In the FY 2023/24, the National Treasury targets to raise Ksh. 718.88 billion of which net foreign financing amounts to Ksh. 131.47 billion and net domestic financing totals Ksh. 587.41 billion. Borrowing through Government securities amounts to Ksh. 584.22 billion. The USD 2.0 billion Eurobond maturity has been budgeted for in the approved budget of FY 2023/24 and maturity will be honoured in time.

Updated on 28th September 2023

For enquiries contact: pdmo@treasury.go.ke